Intro

The Inflation Reduction Act, or IRA, was passed into law August 16, 2022. It is officially H.R. 5376 and you can read the full 276-page bill here on Congress.gov to find the relevant sections on incentives and applicable energy and sustainability projects.

Thankfully, you don’t need to do that, because we did it for you.

This resource article will detail how the IRA will help public and private sector energy users pay for energy & sustainability projects in 2023 and beyond. If you are a business owner, facility manager, school, city, university, or other commercial property owner/manager, this one’s for you.

Background

The Inflation Reduction Act includes funding for a wide range of programs. As a leading provider in energy efficiency, renewable power, microgrids, grid security, etc., we are focused on those involving Energy Conservation & Renewables.

The IRA also includes energy related incentives for residential customers. However, this is not the focus of our article as we focus on supporting commercial and public sector energy users.

We are also not going to delve very deeply into incentives for utility scale systems (off shore wind power, very large solar systems, etc.).

Our focus is on the facility owner and/or manager.

If you’d like to read the source document, start on Page 90 of the PDF linked in the top of this article. “Subtitle D—Energy Security” is what will likely be of interest to you.

One last point before we get started.

There are a number of caveats, small changes based on certain dates, phase outs after 2032, etc. throughout the law. We decided to simplify down to a typical project installed in in the next several years. We didn’t want you to end up like this guy.

The information in this article should not be construed as legal advice. Please confirm all information on your specific project with your energy services company, accountant, attorney, etc.

Qualifying Projects

Most of what you’ve heard about the IRA tax incentives likely centers around solar and wind. This is the area that will see the biggest impact from the law, but energy efficiency projects will also be getting a big boost through an expanded 179D program.

Here’s a non-exhaustive list of the projects that benefit from the IRA that a facility owner might be interested in.

- Solar (ground or roof mount)

- Wind

- Geothermal Heat Pumps

- Fuel Cells

- Combined Heat & Power

- Waste Energy Recovery

- LED Lighting Retrofits

- Building Envelope Improvements (insulation, windows, etc.)

- HVAC replacements

- Control System Upgrades

- Re-commissioning of Systems

Available Incentives

Incentives for commercial properties are generally structured as tax credits or deductions. There may still be other rebates available through your local utility or grants through other state or federal programs, but the IRA is all about Federal tax benefits.

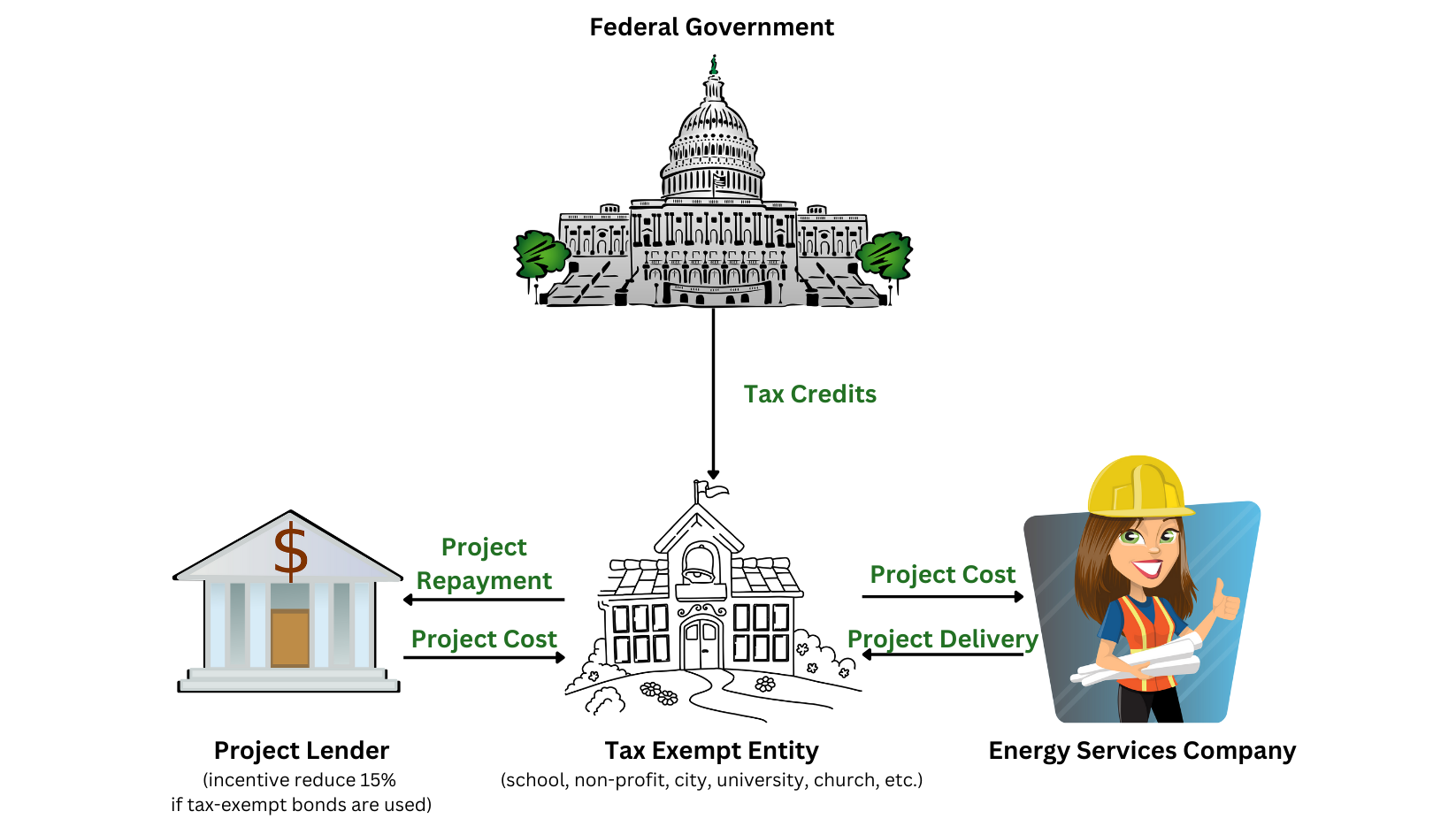

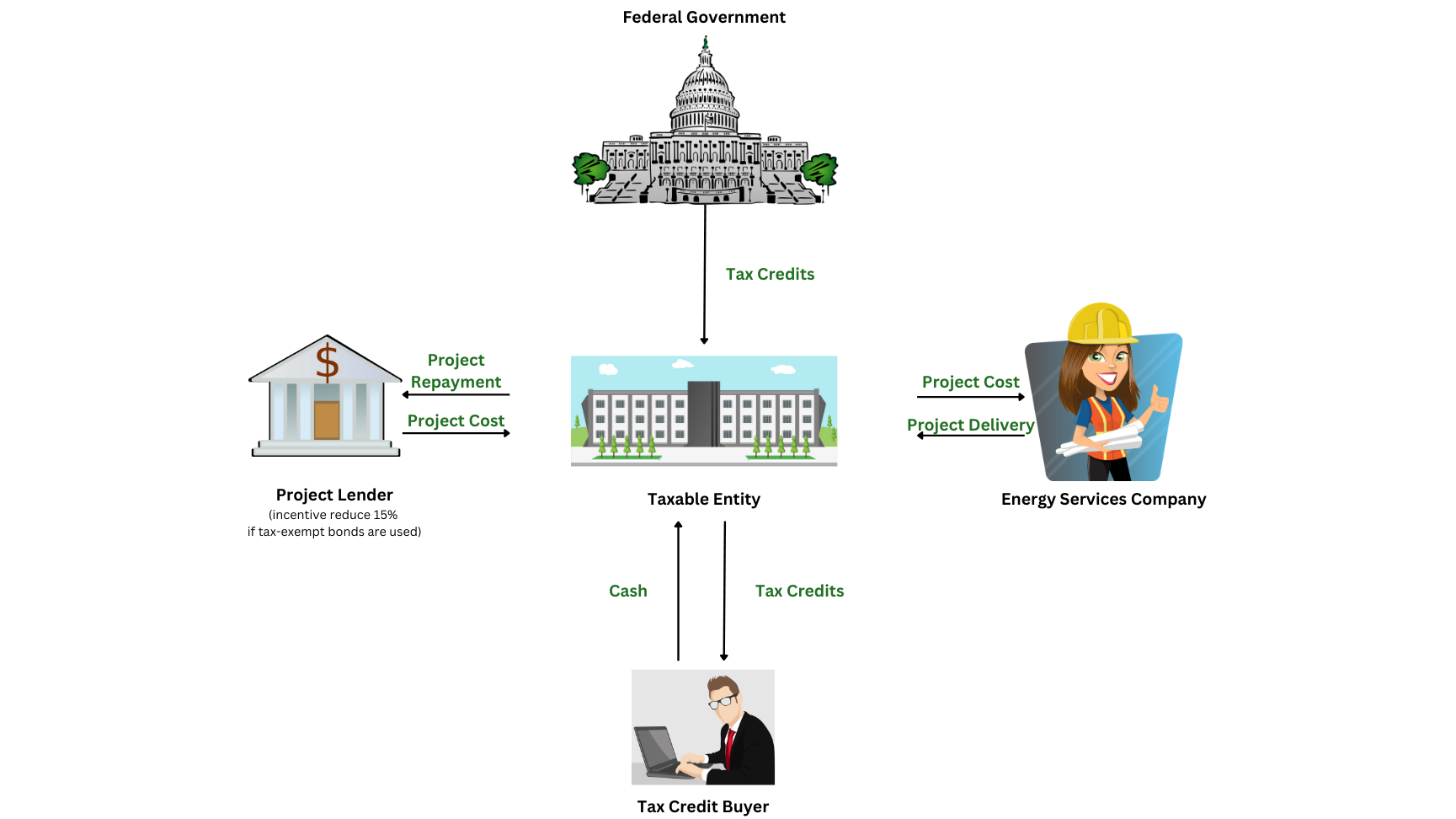

Direct Pay & Transferability

While the incentives are structured as tax benefits, the IRA has made it much easier for customers that are either tax-exempt or do not have the tax appetite to realize a credit or deduction.

Direct Pay

Direct Pay is available for Tax-Exempt entities like schools, non-profits, churches, cities, universities, non-profit hospitals, etc. Under Direct Pay, the credit is paid to the owner directly, without a need for a tax equity partner.

This is significant, as tax equity partners often took about 30% of the credit as a fee for funding the transaction. Now the end user can receive all of the benefit, essentially as a cash rebate.

Note that in order for a tax-exempt entity to qualify for full Direct Pay, the project must meet the domestic content minimum if it is over 1MWac (solar/wind). That also means the credit will also be around 40%. More on domestic content minimums later.

One Time Transfer

If a customer is taxable, but doesn’t have enough tax appetite of their own, they can transfer the credit for cash. Some discount may be received as a fee for cashing out the credit, but it should be nominal as long as the process is easy to process.

Here’s some more details on each of the incentive models.

PTC Details

The Production Tax Credit pays based on how much renewable power is produced (measured in kilowatt-hours/kWh). This amount is paid out during the first 10 years the system is in service.

The Production Tax Credit for a typical facility sized project under 1MW starts at $0.027/kwh. If the system is over 1MW the credit starts at $0.021/kWh.

The values on 1MW or smaller systems will increase by $0.003/kwh if they meet the domestic content minimums. It will increase by another $0.003/kWh if in an Energy Community. There are no bonuses on the PTC for low income communities.

For systems over 1MW, the bonuses above are $0.002/kWh for both the domestic content and energy communities.

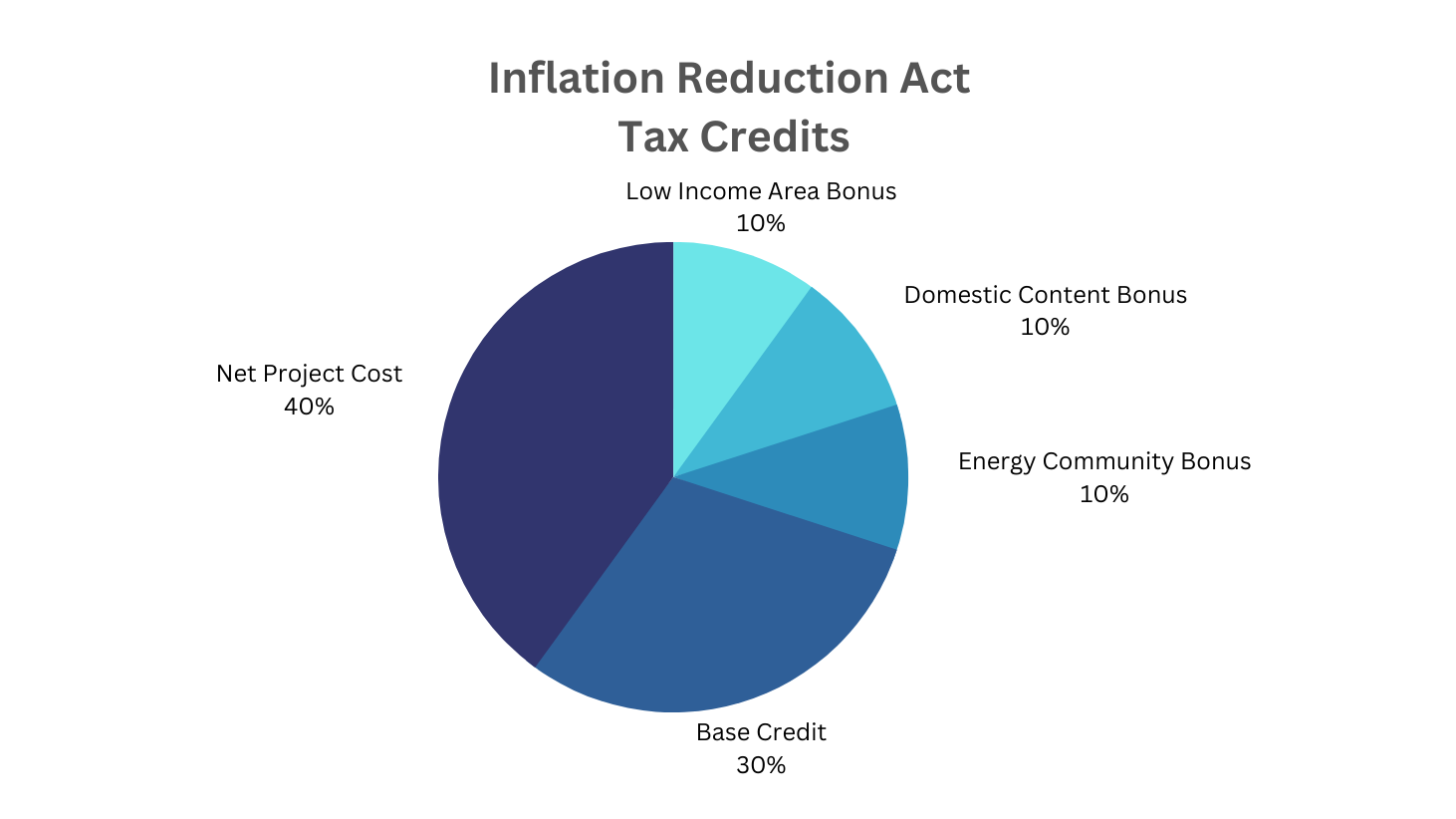

ITC Details

The Investment Tax Credit (ITC) pays based on the cost of the system. For projects under 1MWac, it starts at 30% assuming wage and labor requirements are met. There’s an additional 10% bonus for domestic content, 10% for energy communities, and 10% for low-income areas or 20% for low-income residential building project.

This means any project could easily attain a 40% credit and if it’s located in the right areas that could go to 50% or 60%.

If the project is above 1MWac in size, these numbers drop a bit to 24% base + 8% per domestic content and energy community bonus. The Low income stays at 10%, assuming the project is still under 5MW.

Assuming the project is under 5MW, any cost for interconnection can also be counted to the project cost and the credits above will apply.

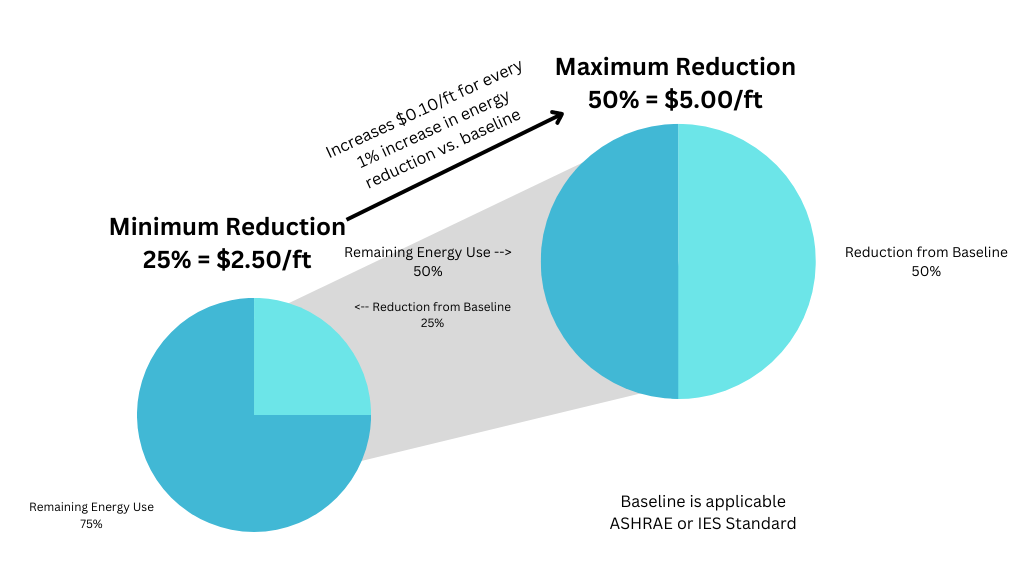

179D Details

179D is based on how much energy is saved vs. a “baseline”. This baseline isn’t the energy used prior to the project, but the applicable ASHRAE or Illuminating Engineering Society standards. The applicable standard depends on when the project is completed. Currently (as of December 2022), ASHRAE 90.1-2007 is the baseline, but the Secretary of the Treasury will likely update this to a newer standard soon.

Once the applicable standard is determined, the project must save at minimum 25% from this baseline. The deduction will be $2.50 per square foot if the project meets the minimum. For every 1% improvement over 25% reduction, the incentive will increase by $0.10/sq. ft. This is capped at 50%, which would be $5/ft.

179D Example

Suppose you have a 100,000 square foot facility and complete energy efficiency improvements that will put your new energy usage at 30% below the ASHRAE/IES standards. The tax deduction from this project would be $3/ft, or $300k. Since the Federal Tax Rate for businesses is about 21%, the value of this is $63k, or $0.63/ft.

If the project cost $6/ft to achieve these savings ($600k), this is a net savings to the project of more than 10%.

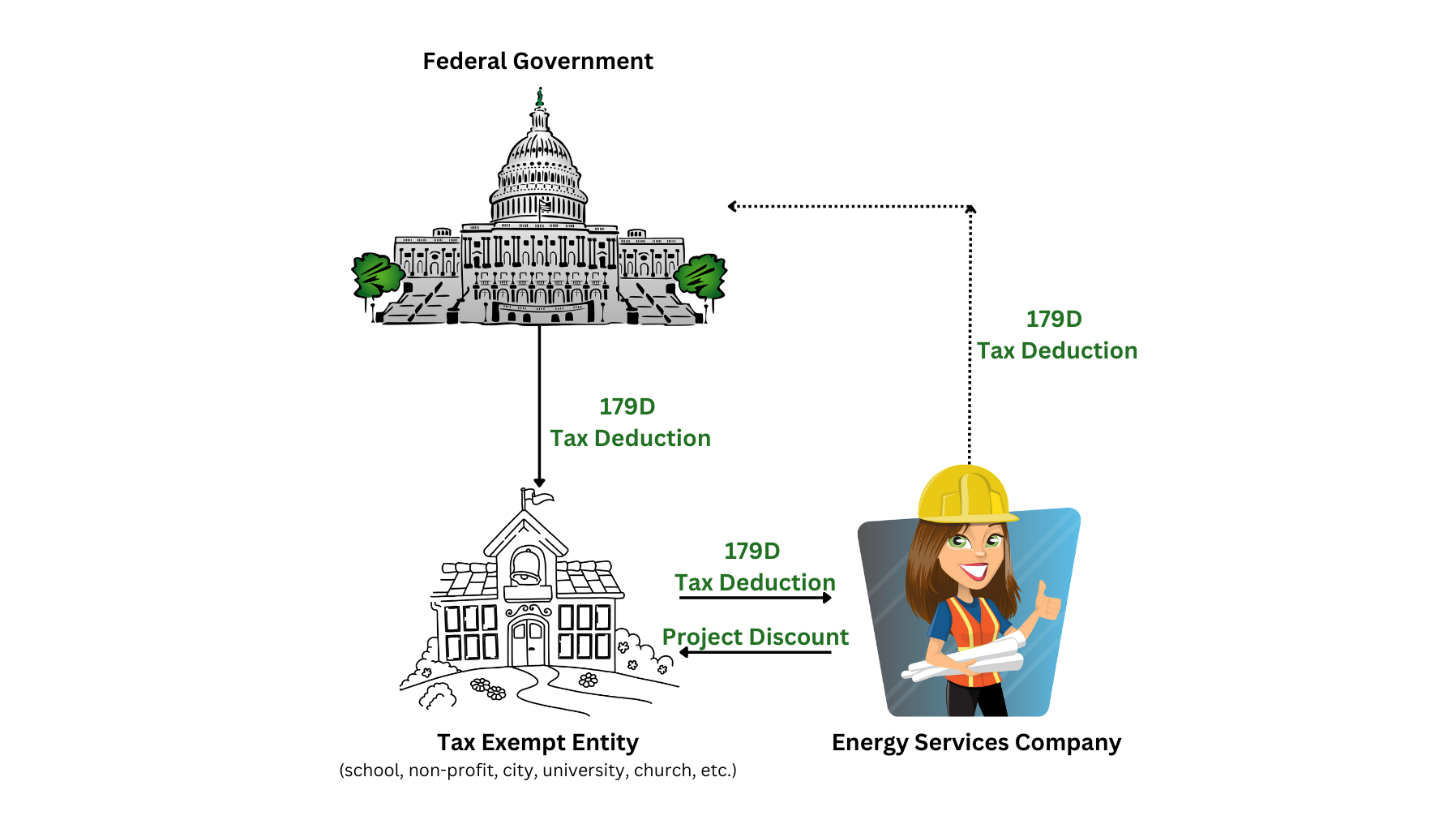

As in the past, if a project is with a tax-exempt entity, a company involved in the design and/or delivery of the project can take the deduction on the owner’s behalf. This should be translated into a project cost deduction for the owner.

The owner should be aware of the value of this deduction on their project and negotiate the discount on project cost accordingly. Do not expect a full 100% value, as there is some administrative cost to the contractor realizing the deduction.

PTC, ITC, 179D – Which is best?

If a project is focused on energy efficiency, such as LED lighting, building automation, HVAC, building envelope, etc., 179D is your only option. PTC and ITC are mainly for energy generation projects that reduce carbon (solar, wind, combined heat and power, etc.). You can get both on a project that includes both energy efficiency and renewable energy production.

For comparison of the PTC and ITC, let’s consider a solar system producing 1,000,000 kwh/yr (about a 650KW DC system in North Texas) that meets the domestic content minimums and wage and labor requirements. Assuming the system cost $2.25/W, it would cost a bit under $1.5M total.

Under the PTC, this system would pay $30k per year for 10 years. The total PTC would be $300k, or 21% of the system cost (not counting time value of money or inflation adjustment).

If we take the same system under the ITC, the credit would be 40% (assuming same bonus credits and wage/labor). That’s $585k back upon project completion. Additionally, if the project was in a low-income community it would get another 10% back, which is not an option with the PTC.

Given these examples, the ITC is the winner. This will likely be the case for most facility level projects. However, each system should be compared on a total cash flow basis to determine which is preferred.

Project Funded by Tax-Exempt Bonds

There is a small reduction for projects funded by tax-exempt bonds. Essentially whatever credits are received are reduced by 15%. There is another way to calculate this that could be a bit less than 15% and it may be prorated if you’re only funding a portion with tax-exempt bonds, but assume 15% reduction for back of the envelope calculations.

Since the tax-exempt rate will be lower than a taxable rate and a tax-exempt owner (school, city, etc.) can take the ITC directly, it will likely still be worth funding the project with tax-exempt debt. You should run the numbers both ways though to see if the reduction in credit is worse than the increase in rate over the life of the project.

Bonus Credits

We’ve mentioned the “bonus credits” a few times. These are “adders” to the ITC and PTC based on the project meeting certain criteria. Generally, they are 10% each.

Note these bonuses are where the ITC really takes over the PTC, because the PTC only increases about 10% on the credit (basically $0.027/kwh to $0.03/kwh) whereas the ITC increases 10% based on the project cost (so instead of $300k on a $1M project it becomes $400k). The ITC bonuses are “stackable”, so if you meet all three bonuses you’d be at 60% credit back on your project cost.

Wage & Labor Requirements

All projects, whether PTC, ITC, or 179D, should plan to meet the wage and labor requirements. If you don’t, the incentives are reduced by about 80%. For example, the 179D credit starts at only $0.50/ft instead of $2.50/ft.

To meet the wage requirement, projects must pay prevailing wage. This is typical of federally funded projects and not a major inconvenience. It does, however, need to be correctly documented and catalogued for reporting and verification.

The workforce requirement is focused on using Apprentice labor on projects. If a project will use 4 or more workers, at least one must be an apprentice. Beyond that minimum, total hours must be 12.5% apprentice in 2023 and 15% apprentice in 2024 and beyond. Again, this isn’t difficult, but proper documentation must be kept.

Domestic Content Bonus

If a project uses USA made materials, it will be eligible for additional incentives. We detailed these earlier and will summarize at the end.

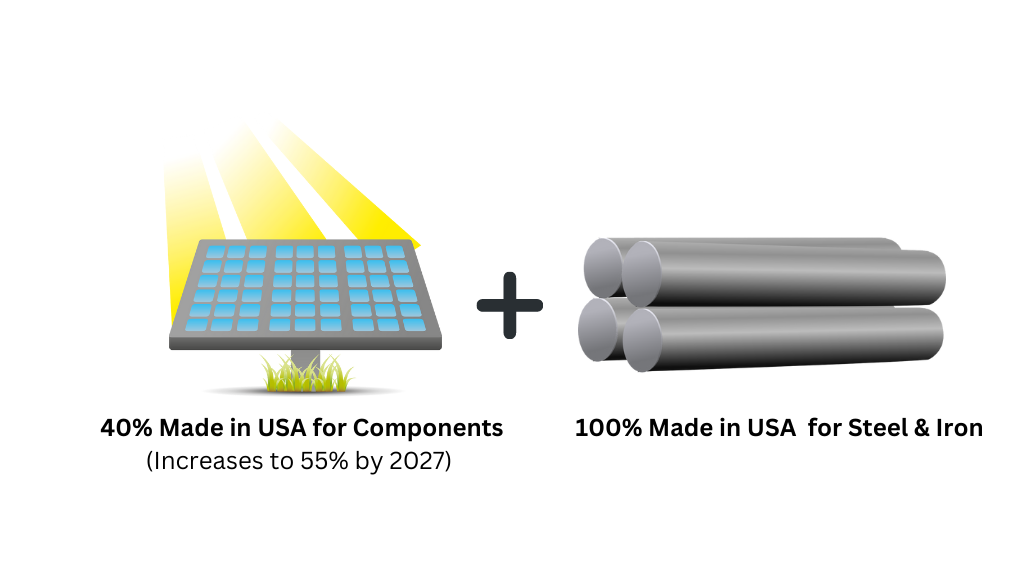

Domestic Content relates to the steel or iron in a system and the manufactured products.

To qualify, 100% of steel and iron must be Made in the USA. On manufactured products, the “products which are components of a qualified facility upon completion of construction shall be deemed to have been produced in the United States if not less than 40% of the total costs of all such manufactured products of such facility are attributable to manufactured products (including components) which are mined, produced, or manufactured in the United States.”.

This 40% minimum will increase a bit each year till they reach 55% in 2027.

Energy Community Bonus

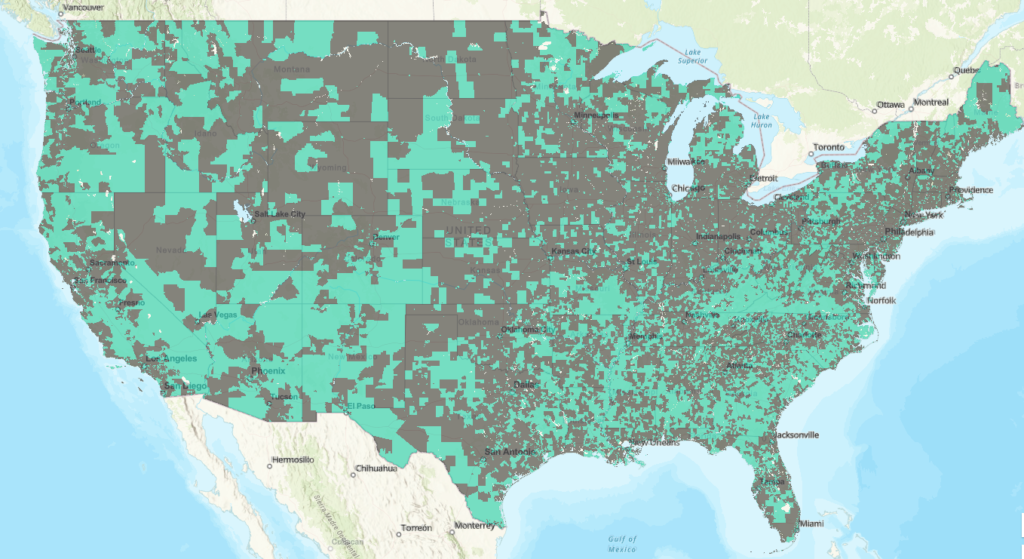

If a project is in an “Energy Community”, it will qualify for a bonus. This bonus is a bit more confusing as there are three different ways to qualify. Many thanks to this Resources.org article for providing a good summary and the maps detailed below.

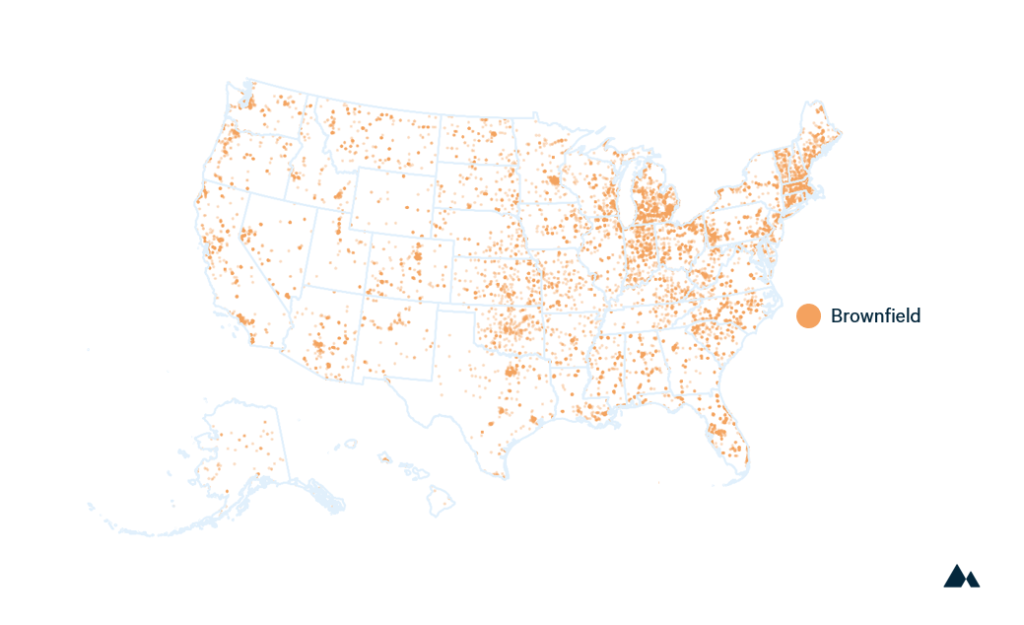

Option 1 – Brownfield Sites

If the project is based in a brownfield site, it will be eligible for the Energy Community bonus. This means a small plot of land could qualify even if the larger general area was never involved in the coal or oil industry.

The term “brownfield site” means “real property, the expansion, redevelopment, or reuse of which may be complicated by the presence or potential presence of a hazardous substance, pollutant, or contaminant” (subparagraph (A) of section 101(39) of the Comprehensive Environmental Response, Compensation, and Liability Act of 1980 (42 U.S.C. 9601(39)))

Here’s a map from the EPA showing brownfield sites. Since sites may be very small, a national map isn’t a huge help here. You may have a small qualifying site that is just a lot or a few acres.

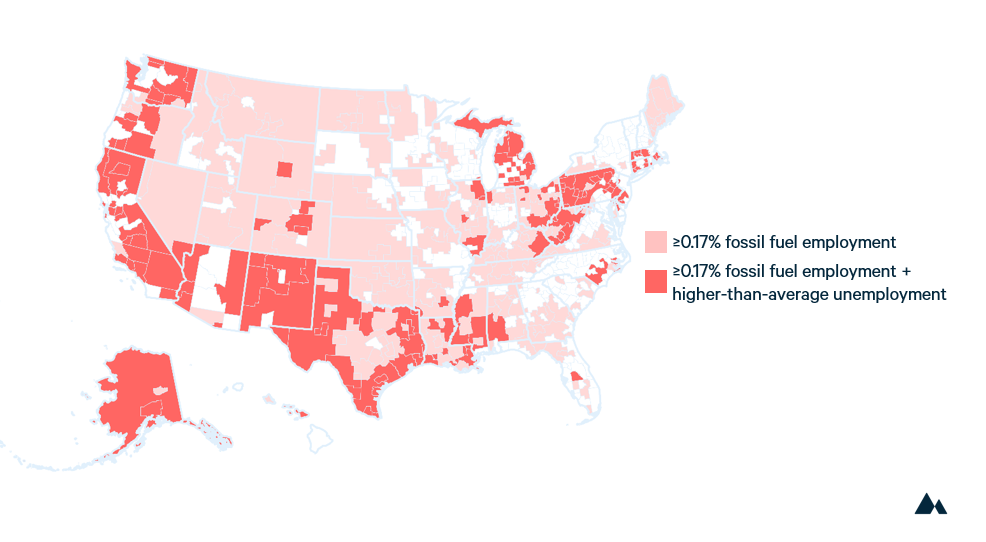

Option 2 – Coal, Oil, or Natural Gas Employment Areas

The other option is if the project is based in an area generally employed in the coal and oil industry, with unemployment rate at or above national average.

To qualify, direct employment related to the fossil fuels industry must be 0.17% or greater or 25% of local tax revenues must be related to fossil fuels (extraction, processing, transport, or storage). Unemployment must also be at or above national average.

Here’s a map that was created based on US Census Data the 0.17% data and recent unemployment data overlaid.

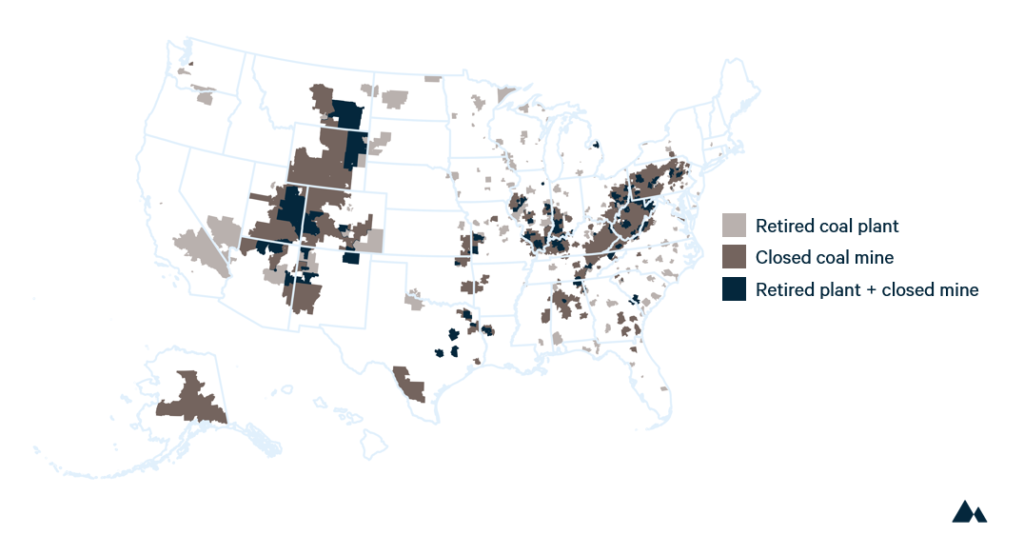

Option 3 – Retired Coal Plants & Closed Coal Mine

The third option for meeting an energy community is being in an area nearby a retired coal plant (since 2010) or closed coal mine (since 2000). These areas are defined by census tract.

Here’s a map that was created based on Form EIA-860 surveys and US Mine Safety and Health Administration data sets.

Low Income Community Bonus

If a project is based in a Low-Income community, it can receive an additional 10% under the ITC. This same bonus also applies if it is on Indian Land.

The low-income community is defined by Code Section 45(d). Here’s a snapshot of the Country with the areas that meet this criterion. Reach out to us if you want to see if your specific site is in a qualifying area.

In addition to the general low-income area, there’s an even greater bonus for projects serving qualified Low-Income Residential Building Project or Qualified Low-Income Economic Benefit Project. If you are a multi-family developer or owner you are likely familiar with these terms and know if you have these projects in your portfolio.

If so, your project can get a 20% credit. Note that at least half of this needs to be passed on to the residents, so the financial ROI should be modeled accordingly.

Bonus Credit Summary

If you’re going for Bonus Credits, the ITC is much more valuable than the PTC. Since they can stack on one another, it shouldn’t be difficult to get 40% and if you are able to qualify for low-income and/or energy community it will go to 50% or 60% of your project cost.

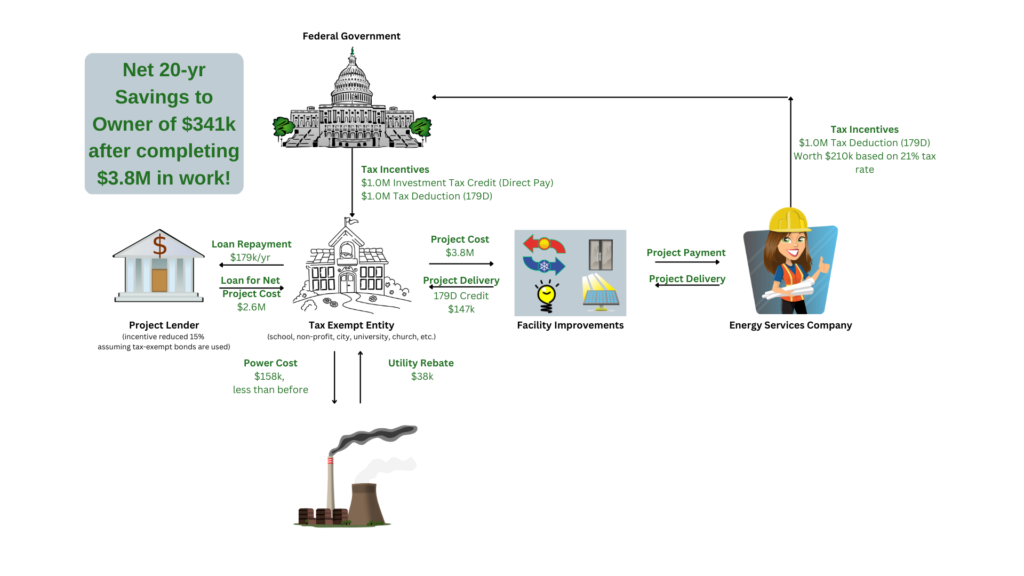

A Closing Example

Scenario

Let’s assume you’re a school district with 3 schools totaling 350k square feet. You’re in a low-income area and are looking to reduce your annual costs and upgrade aging infrastructure. You also have to improve the security at the high school through a security vestibule. You have a flat roof in good shape. About half the HVAC units are older and all of them have programmable thermostats. Most of the lights still aren’t LED. You also have a 5-acre piece of land near the school that doesn’t have plans for future use. Current utility expenses are $400k/yr, with $325k of this being electric and the remainder gas and water.

Scope of Work

We put together a project that includes replacement of 25% of the HVAC units, a centralized control system for all of them, an LED lighting conversion, some weatherization of the building envelope, and a new security entry vestibule at the high school. We also put solar on the 5-acre parcel.

Total cost for the energy conservation and vestibule work is $1.3M. Together they reduce utility usage by 13.6%, which is worth $55k/yr. This is 28% below the ASHRAE/IES baseline, so there’s a deduction of $2.80/ft, or $1.0M, which is worth $210k cash. The contractor takes this credit and passes along $147k to you. They also get a utility rebate of $38k, bringing net project cost down to $1.2M.

The solar system is kept to 960 KWac, or 1.2MWdc, which will produce about 1.85 million kWh/yr. This is worth $103k/yr based on your current grid electric rate. The system costs $2.5M gross, but with the tax credit this is cut by 42.5% (it would be 50%, but we’re assuming you’re financing with tax exempt debt, so there’s a 15% reduction).

Financial Impact

Total gross project cost is now $3.8M with $1.2M coming back in incentives. The net cost of $2.6M is financed at 3.5% over 20 years, for an annual payment of $179k. The project saves $161k after considering any maintenance cost/savings of the new equipment, leaving a net cost to the first year M&O budget of $18k. However, over time the impact of energy cost increases will be mitigated by the energy efficiency and solar work. If we assume a 2% annual inflation escalator on grid power cost we realize a total net savings to your M&O budget of $341k over 20 years.

This example doesn’t consider additional benefits from future utility cost inflation, maintenance cost reduction, additional grants and utility rebates, etc. Hopefully it gives some idea though of just how powerful the new incentives will be in helping facility owners make financial sense of these projects.

Summary & Next Steps

We spent hours in research to gain the information we presented here. As we said at the beginning, this is a simplified summary and doesn’t address every possible scenario laid out in the legislation.

If trying to understand everything on your own is overwhelming, feel free to reach out to us directly. Using our holistic approach we’ll first look to understand your goals and then determine which projects and corresponding incentives are best for you.

If you’d like, you can also email me to receive our free 1-page summary of the key data.

Thanks for reading and we look forward to speaking with you soon.

Be Blessed,

Ira

PS – Did I miss an opportunity to call this article “Ira on the IRA”?