There are two main ways to finance a commercial solar system; direct ownership (cash or financed) or leased (Power Purchase Agreement or equipment lease). Each method has pros and cons, which we’ll discuss in this article.

What Does a Commercial Solar System Cost?

Regardless of how a system is financed, the first question you should ask is what does the system cost.

We’re talking installed dollars per watt ($/W).

Strip away all of the fancy financing structures, utility rebates, and tax incentives and you just need to know what a system costs.

Think of it like buying a car. When you shop you want to see the actual purchase price, but when you go into the dealership the salesperson may just want to talk about the payment!

Whether you plan to own directly or lease, don’t fall for the payment scheme. Know what you’re paying and then determine how to finance it.

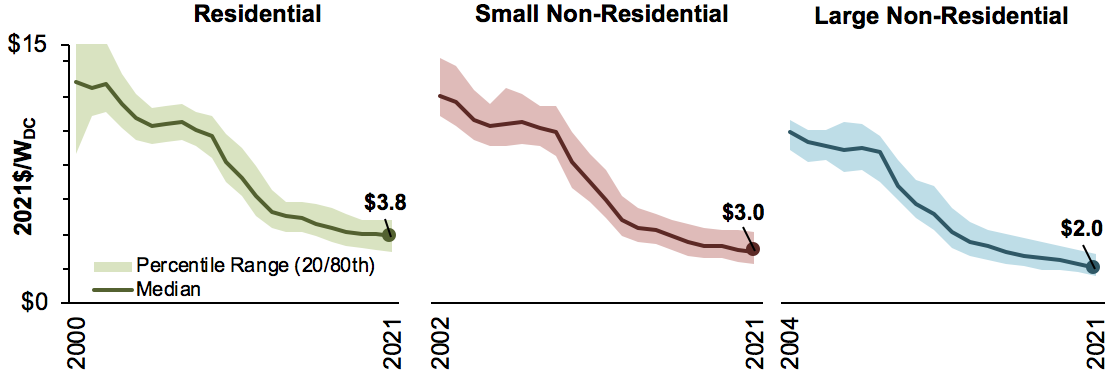

A good resource on what a system should cost is Tracking the Sun by the Lawrence Berkley National Laboratory. They have breakdowns by state, system type, and more. Below is a summary:

Who Receives the Solar Tax Credit?

The Inflation Reduction Act expanded and extended tax credits for solar systems. Commercial systems will now see anywhere from a 30% to 60%+ credit. You can read more about the credits and the IRA in this article we wrote.

You can’t do a PPA and get the Tax Credit

Tax credits are paid to whoever owns the system. If you use a PPA or lease, you don’t get the credit. Whatever value it has is built into the PPA/lease rate you pay.

Since this is a credit, you need to have enough Federal tax to realize the value yourself. If you paid more than the amount of the credit, you’re all set. Your tax bill will just be reduced that much.

The exception to this is if you are a tax exempt entity, in which case you basically get paid the value of the credit directly (called Direct Pay).

If you are an individual or business without enough tax appetite, there is now a provision to transfer the credit to someone else. As of this writing we’re still waiting for details on how this will work, but we expect you’ll get 85-94% of the credit value when you sell it. Here’s a good resource to read more if interested.

Who Maintains your Solar System?

Solar systems don’t require much maintenance, but it is wise to check them over at least once a year and occasionally wash any accumulated dust and grime off the panels.

With a PPA, you don’t own the system so you typically aren’t responsible for maintaining it. Any service should be included in the PPA rate.

If you own the system and don’t want to do the maintenance yourself, you could always get a service contract with a 3rd party to maintain them.

In either case, the key is to know what service you are getting and what it costs.

Keep in mind most parts in a solar system will have manufacturer warranties. Like any warranty you need to understand the fine print (labor coverage, depreciated value, etc.), but generally you have some coverage if systems fail even if you don’t have a service contract.

What Happens to your Solar system if You Move?

As a business owner, it’s important to understand what happens if you move offices.

With a lease or PPA, the solar company will often say it can just transfer to the new owner.

The reality is that whoever is buying your building may not want the solar system or not be able to qualify for credit to take on the contract.

If a system is owned, the transfer is much more straightforward. You may or may not get additional value for the system, but at least it won’t be a big impediment to the sale.

Note that if you own the system, but have financed it, you may incur a lien or similar clause again your property. This adds additional complexity to the sale.

For future proofing against a move, we recommend owning the system directly.

Do You Really Have Green Power?

Whenever renewable power is generated, it creates a Renewable Energy Credit (REC). This can be tracked and traded on the market.

It’s counterintuitive, but even if the panels on your building are wired directly in to your electrical system, you aren’t actually able to say you are using green power if someone else has bought the REC for your production.

Under most PPAs, the system owner will sell these RECs to help generate more revenue. Many times they’ll offer a “REC Swap”, where you get some lower grade, cheaper RECs (say from an existing wind or hydro system) and they sell the more valuable solar REC. In this case you can say you are using renewable power, but it isn’t really the power from your system.

If you own the system you can decide to not sell the REC. That way the green power you produce is actually being used by your property. Simple.

Beware Solar PPA Escalation Factors

Many Power Purchase Agreements have a predetermined annual escalation factor. A PPA is just a rate you pay for power produced. The escalation adjusts this rate.

The theory is that the cost of buying power from the utility will increase as well due to inflation.

While this is generally true, there are times when grid power has been flat or even gone down in price. A PPA with a predetermined escalation factor will always go up and could put you in a position where buying the power from the panels is more expensive than buying power from the grid!

Comparing Financials

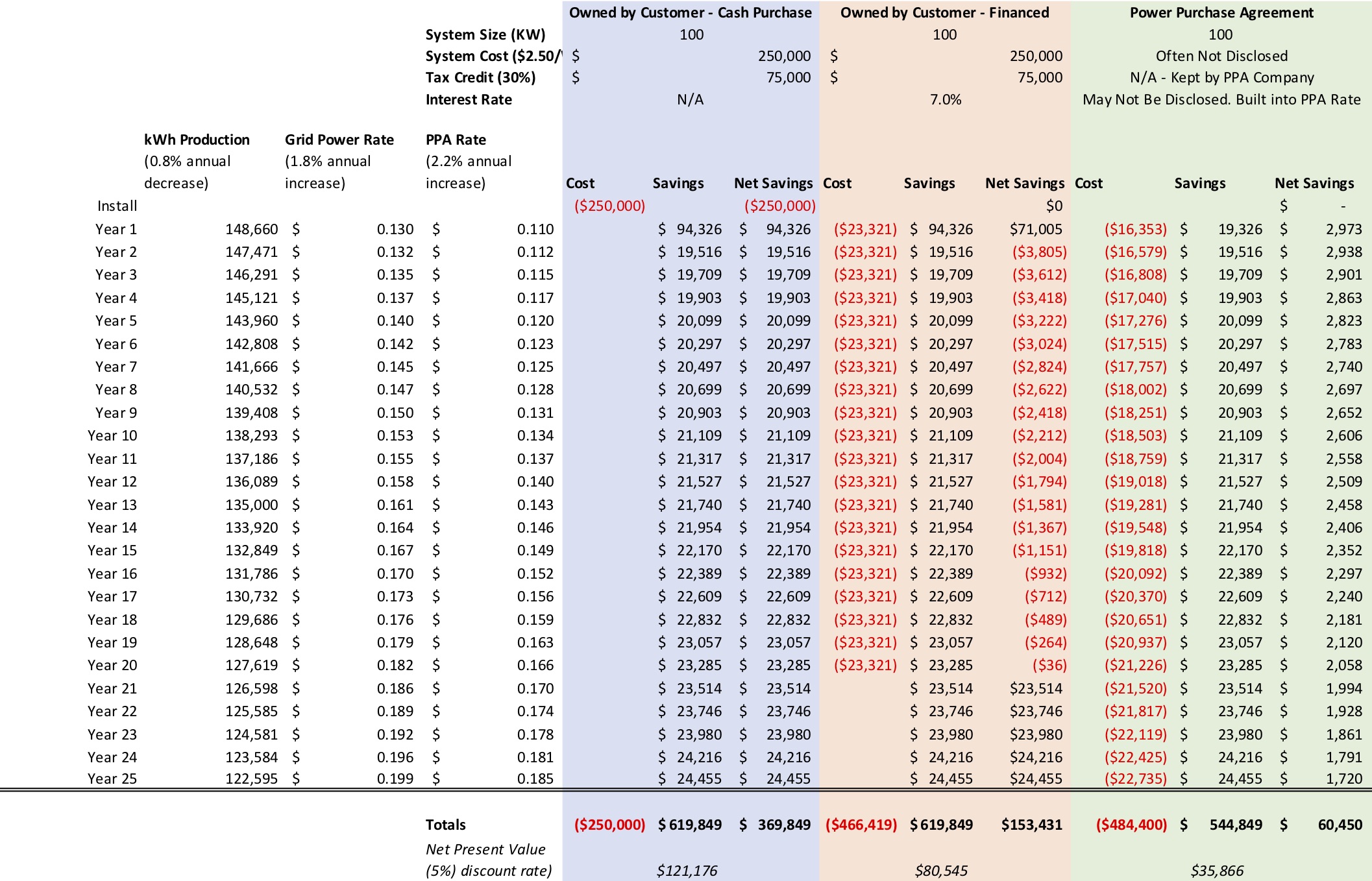

Comparing long term, complex financial investments is best done with a Cash Flow Analysis. Once you determine exactly what the projected cost and savings is for each future year you can use a metric like Net Present Value (NPV) to discount the time value of money and compare all options in today’s dollars.

Here’s an example.

In the above example, we assumed the financed rate is 7% over 20 years. We factored in the tax credit, but did not factor in accelerated depreciation (this would apply to businesses owning the system)

We see that Net Present Value is highest for the cash purchase. We used a discount (or hurdle) rate of 5%.

At the 5% hurdle rate, all projects have a positive Net Present Value. This means you’d move ahead with the project in any scenario, but the cash purchase is the best in this situation.

So What’s the Conclusion?

In general, we recommend owning a system instead of leasing it or using a PPA. Owning takes a bit more work, but it is generally the better financial payoff. It could simplify things down the road if you move.

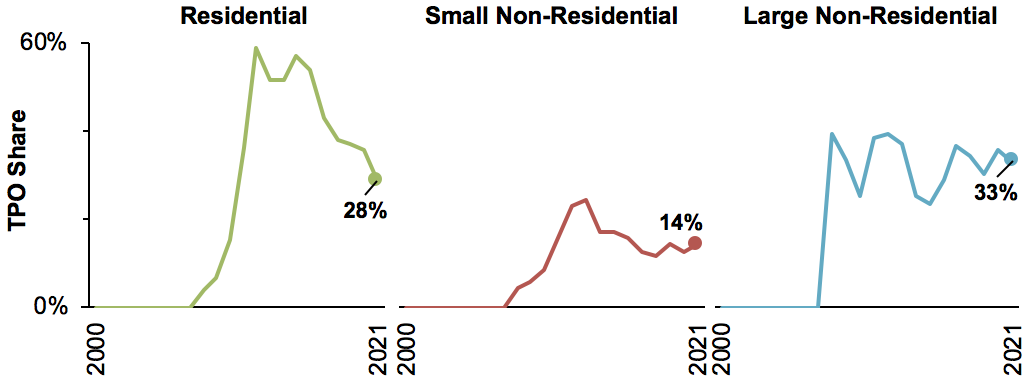

Based on the LBL data, most buyers agree with us. Below is a graphic showing the percent of Third Party Ownership (TPO) and you can see about 2/3rds of system are owned. We predict this will only increase with the Direct Pay and One-Time Transfer provisions of the Inflation Reduction Act.

Let us Help

We understand that comparing all of this information is complicated and can be confusing. We tried to simplify it for this article, but truth is we barely scratched the surface. Add in the technical considerations and it can be overwhelming.

If you’d like, we offer a service to help evaluate your specific project and make a recommendation. We do this for both residential and commercial systems.

Send us an email at info@HolisticUS.com to begin a discussion on your project.